CBN Announces New ATM Fees: How Will It Affect You? – Effective March 2025

- Advertisement -

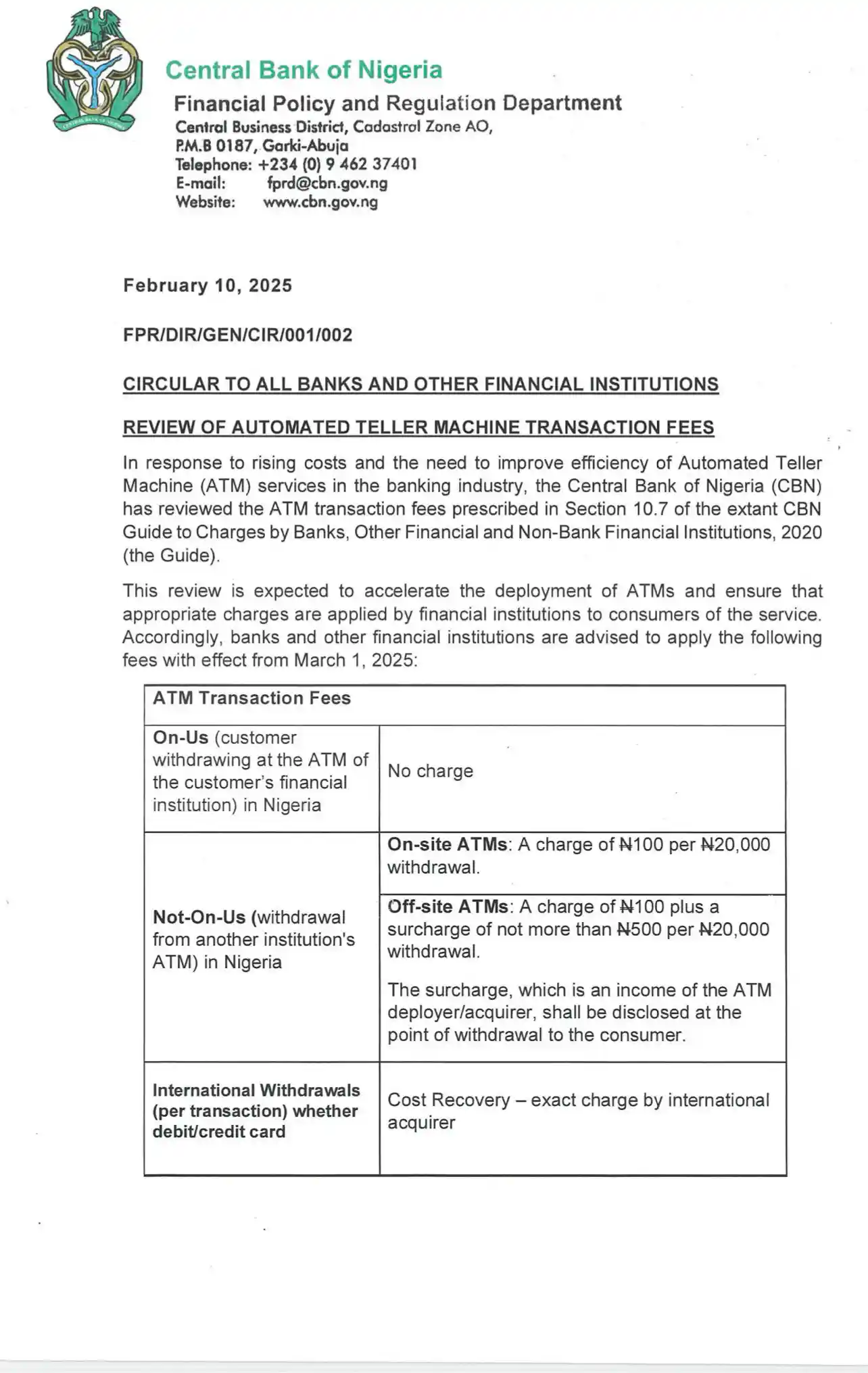

The Central Bank of Nigeria (CBN) has announced a review of Automated Teller Machine (ATM) transaction fees, which will take effect from March 1, 2025. This update impacts how Nigerians withdraw cash from ATMs, especially when using machines operated by banks other than their own.

With rising operational costs in the banking sector, the new charges aim to encourage wider ATM deployment while ensuring that financial institutions apply appropriate service fees. Here’s everything you need to know about the new CBN ATM withdrawal charges in Nigeria for 2025.

CBN’s New ATM Transaction Fees in Nigeria – March 2025 Update

- Advertisement -

According to the latest CBN circular dated February 10, 2025, the new ATM withdrawal fees are as follows:

1. On-Us Transactions (Withdrawals from Your Own Bank’s ATM)

✅ No charges for customers withdrawing money from an ATM operated by their own bank.

- Advertisement -

2. Not-On-Us Transactions (Withdrawals from Another Bank’s ATM)

💳 On-Site ATMs (Located within bank premises):

- ₦100 per ₦20,000 withdrawal.

- Advertisement -

💳 Off-Site ATMs (Located outside bank branches – malls, fuel stations, etc.):

- ₦100 per ₦20,000 withdrawal + a surcharge of up to ₦500 per transaction.

- The surcharge is an income for the ATM deployer/acquirer and will be disclosed at the point of withdrawal.

3. International ATM Withdrawals (Debit/Credit Card Transactions)

🌍 Charges will now be based on cost recovery, meaning users will pay exactly what the international acquirer charges.

- Advertisement -

How Will the New CBN ATM Fees Affect Nigerians?

1. Increased ATM Withdrawal Costs for Non-Home Bank Transactions

Withdrawing cash from an ATM that does not belong to your bank will now cost at least ₦100 per ₦20,000, and up to ₦600 per withdrawal if using an off-site ATM.

2. More Customers May Shift to Digital Banking

With rising ATM withdrawal fees, Nigerians may turn to alternative banking methods like:

- Mobile banking apps (Kuda, Opay, PalmPay, Carbon, Paga).

- POS agents who offer cash withdrawals for a small fee.

- USSD banking for transfers and bill payments.

3. Banks May Deploy More ATMs

The CBN’s goal is to encourage banks to install more ATMs nationwide, making it easier for customers to access their funds without excessive charges.

How to Avoid High ATM Withdrawal Charges in Nigeria

To minimize extra ATM fees, consider these cost-saving strategies:

🔹 Withdraw Cash Only from Your Bank’s ATM – You won’t pay any charges.

🔹 Use Digital Banking & Fintech Apps – Apps like Kuda, Opay, and PalmPay offer zero withdrawal fees when transferring to other users within their platforms.

🔹 Use POS Agents for Withdrawals – In many areas, POS withdrawal fees are lower than the new ATM charges.

🔹 Plan Larger Withdrawals – Instead of multiple small withdrawals, consider taking out larger sums to avoid repeated ₦100-₦600 ATM fees.

Alternative Banking Solutions to ATMs in Nigeria

With higher ATM charges, more Nigerians may consider digital banking platforms for financial transactions. Here are some of the best alternatives:

1. Kuda Bank (Zero-Fee Banking)

- Free transfers and zero ATM withdrawal charges.

- Mobile banking with instant notifications.

2. Opay & PalmPay (Mobile Money Solutions)

- Easy cash deposits & withdrawals.

- Bill payments, airtime recharge, and interbank transfers.

3. POS Agents (Quick & Affordable Withdrawals)

- Widely available across Nigeria.

- Lower charges than the new ₦600 off-site ATM withdrawal fee.

Pay Attention To : Top 10 Essential Mobile Apps Every Nigerian Should Have in 2025

Frequently Asked Questions (FAQs) on CBN’s New ATM Charges

1. When do the new ATM withdrawal charges take effect?

📅 The new CBN ATM transaction fees will be implemented starting March 1, 2025.

2. How much does it cost to withdraw money from another bank’s ATM in Nigeria?

💰 You will pay ₦100 per ₦20,000 withdrawal at on-site ATMs and ₦100 + up to ₦500 surcharge per ₦20,000 withdrawal at off-site ATMs.

3. How can I avoid ATM withdrawal fees in Nigeria?

✅ Use your own bank’s ATM to withdraw for free.

✅ Switch to fintech banking apps like Kuda, Opay, and PalmPay.

✅ Use POS agents instead of off-site ATMs to reduce charges.

4. Will international ATM withdrawal fees change?

🌍 Yes. The CBN states that international ATM withdrawals will be charged at the exact cost set by the acquiring bank abroad.

Also Read : How to Make Money Selling on Jumia and Konga in Nigeria: A Step-by-Step Guide

Final Thoughts: What This Means for Nigerians

The new CBN ATM withdrawal fees in 2025 will significantly impact how Nigerians access cash. While on-us withdrawals remain free, using another bank’s ATM can now cost up to ₦600 per transaction.

To avoid extra fees, Nigerians are encouraged to:

✔ Withdraw only from their bank’s ATM.

✔ Use mobile banking apps for transfers.

✔ Consider POS agents as an alternative for cash withdrawals.

As digital banking continues to grow, fintech solutions like Kuda, Opay, and PalmPay may become even more popular as cost-effective banking options.

🔔 Stay updated with the latest banking news in Nigeria! Subscribe to our newsletter for real-time updates.

- Advertisement -