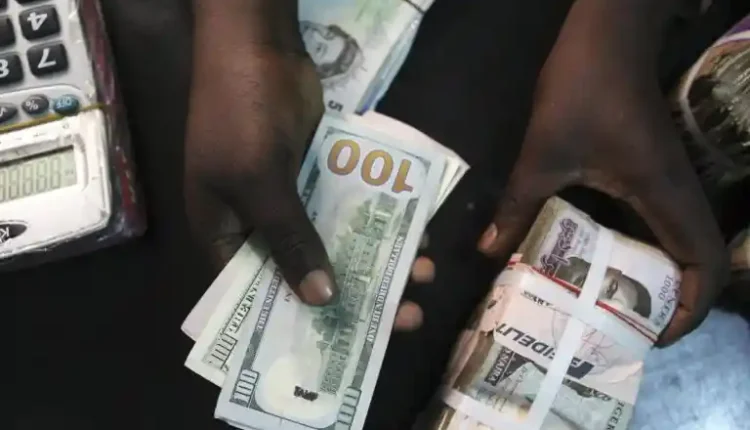

Dollar To Naira Exchange Rate Today, Tuesday, May 20, 2025

- Advertisement -

Dollar To Naira Exchange Rate Today, Tuesday, May 20, 2025 including black market and official rates

As of Tuesday, May 20, 2025, the Nigerian Naira continues to face pressure in both official and parallel (black) markets despite renewed efforts by the Central Bank of Nigeria (CBN) to stabilize the currency.

Currency traders, financial analysts, and business operators are watching closely as the naira fluctuates against the U.S. dollar amid inflation concerns, forex scarcity, and policy adjustments from the Tinubu-led administration.

- Advertisement -

Official Exchange Rate (CBN Rate)

At the Investors and Exporters (I&E) Window, the official exchange rate for the U.S. dollar to Nigerian naira stands at:

- ₦1,510.25 per USD

(As of 9:00 AM, May 20, 2025)

This rate represents a marginal strengthening of the naira compared to the previous day’s rate, indicating slight recovery from last week’s depreciation.

Black Market Exchange Rate (Parallel Market)

Despite the official rate movements, the black market continues to reflect higher figures, underscoring a wide gap between official and unofficial forex channels.

- Advertisement -

Today’s black market rates are:

- Buying Rate: ₦1,620 per USD

- Selling Rate: ₦1,630 per USD

These figures are sourced from reputable currency dealers operating in Lagos, Abuja, and Onitsha. The black market remains the go-to for many businesses and individuals unable to access forex via official channels.

Bureau De Change (BDC) Rates

In some cases, Bureau De Change operators are offering rates slightly lower than the open black market but still above the CBN rate:

- Advertisement -

- Average BDC Rate: ₦1,610 to ₦1,625 per USD

- Location-sensitive Variations: Urban centers like Lagos and Port Harcourt often see slightly higher rates due to increased demand.

Key Economic Drivers Behind the Rate Fluctuations

Several factors are driving the current forex volatility:

1. Dollar Demand by Importers

Importers continue to flood the market with requests for U.S. dollars to finance shipments, creating persistent pressure on available foreign exchange.

2. Speculation and Hoarding

Investors and individuals hoarding foreign currency in anticipation of further devaluation contribute to the naira’s weakness.

3. CBN’s Monetary Policy

While the CBN has introduced new forex auction frameworks and capital control policies, these efforts have yet to bridge the supply-demand gap effectively.

4. Oil Revenue and Reserves

Despite an uptick in oil production, Nigeria’s foreign reserves have not grown substantially due to subsidy settlements and debt obligations.

- Advertisement -

Implications for Businesses and Consumers

- Importers & Exporters: Higher black market rates increase landing costs, affecting prices of imported goods.

- Consumers: Expect continued inflation in commodity prices, especially for electronics, vehicles, and foreign goods.

- Students & Travelers: Those seeking forex for tuition and travel are forced to rely on costly unofficial channels.

- SMEs & Manufacturers: Small businesses unable to access official forex may face severe input cost hikes.

What Analysts Are Saying

Economic analyst Dr. Tunde Bamidele told TJ News Nigeria:

“Until Nigeria expands its forex inflow sources and restores confidence in official markets, the naira will remain vulnerable. The black market is simply reflecting the real demand in the system.”

Similarly, Ngozi Udeh, an Abuja-based trader, lamented:

“Even with CBN promises, we can’t get dollars officially. Everything from electronics to baby food now costs more daily. This exchange rate is killing businesses.”

CBN’s Next Steps: What to Watch

The Central Bank is reportedly planning the following measures:

- A new $2 billion foreign loan to boost reserves

- Forex clearance for airlines and foreign companies

- Increased surveillance on illegal forex trading in major markets like Wuse, Allen Avenue, and Aba

Investors and the public await CBN Governor Dr. Olayemi Cardoso’s next policy briefing expected later this week.

How Today’s Exchange Rate Compares

| Date | Official Rate (₦/USD) | Black Market Buy | Black Market Sell |

|---|---|---|---|

| May 17, 2025 | ₦1,525.50 | ₦1,615 | ₦1,625 |

| May 18, 2025 | ₦1,518.30 | ₦1,617 | ₦1,627 |

| May 20, 2025 | ₦1,510.25 | ₦1,620 | ₦1,630 |

Nigeria’s Currency Crisis Persists

As of today, Tuesday, May 20, 2025, the naira remains under pressure across all markets, with the black market reflecting continued distrust in official forex mechanisms.

While marginal improvements in the official rate may indicate short-term relief, the wide disparity between the official and black market rates remains a major concern for investors, businesses, and everyday Nigerians.

Unless bold fiscal reforms and forex accessibility measures are implemented, the naira’s volatility is likely to continue through Q2 2025.

📌 Stay with TJ News Nigeria for daily updates on exchange rates, financial markets, and CBN policies.

📧 Contact: [email protected]

📲 Follow us on X (Twitter) : @TJNewsNG

- Advertisement -