Nigerian Returnee Cries Out After Over ₦100 Million Disappears from UBA Account: Bank Allegedly Declares Him Dead

- Advertisement -

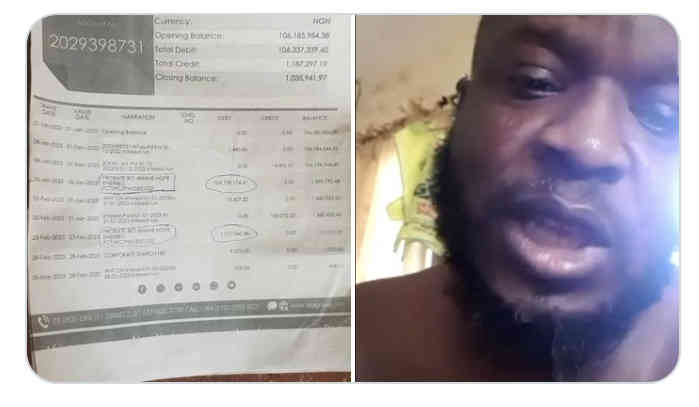

Benin City, Nigeria – A Nigerian foreign returnee, Mr. Ibhahe Hope Ehieribo, is crying out for justice after losing over ₦100 million in life savings mysteriously withdrawn from his United Bank for Africa (UBA) account under highly suspicious circumstances.

The shocking ordeal has left many Nigerians alarmed, as the affected individual claims the bank allegedly declared him dead and buried, allowing an unknown party to claim his funds without his knowledge or consent.

The Shocking Allegation: UBA Allegedly Claims Customer Was Dead

According to Mr. Ehieribo, upon returning to Nigeria after years of hard labour abroad, he was met with a rude shock. When he attempted to access his UBA savings account, he discovered that the entire sum—over ₦100 million—had vanished.

- Advertisement -

When he visited the bank to lodge a complaint, officials allegedly informed him that someone had claimed his funds by falsely declaring that he was deceased.

“They told me I was dead and buried. Someone came and collected my money by claiming I had died. This is my hard-earned money from many years abroad. How can a bank allow such a fraudulent transaction without proper verification?” Mr. Ehieribo said in a video statement that has since gone viral on social media.

Bank Refuses to Disclose Transaction Details

More troubling is the fact that the bank reportedly refused to disclose where the money was transferred to, or who initiated the claim.

- Advertisement -

Despite presenting valid identification and account details, Mr. Ehieribo was not provided any explanation or documentation showing who allegedly impersonated him or how the bank concluded he was deceased.

“I asked them for account statements and details of who claimed the money, but they refused to give me any meaningful information,” he said.

Attempt to Intimidate: Police Involved but Decline to Detain Victim

In a disturbing twist, Mr. Ehieribo revealed that UBA officials allegedly called the police in an attempt to intimidate or detain him when he insisted on getting answers.

- Advertisement -

However, the police reportedly refused to arrest him after reviewing the complaint and recognizing the legitimacy of his claims.

“Even the police knew something was wrong. They saw my passport, my documents, my account details, and everything was in order,” Mr. Ehieribo added.

No Communication from UBA: Silence Fuels Public Outcry

To date, Mr. Ehieribo claims that neither UBA nor any regulatory body has contacted him to provide clarification, refund the missing funds, or launch an official investigation into the matter.

His calls, messages, and follow-up visits have gone unanswered, prompting an escalating online campaign demanding transparency and justice.

Public Reactions: Nigerians Demand Accountability

The matter has generated widespread outrage on social media, where the hashtag #JusticeForHopeEhieribo is gaining traction. Thousands of users are tagging @UBAGroup on X (formerly Twitter), demanding immediate action and accountability.

- Advertisement -

Many Nigerians are asking critical questions:

- How could a customer be declared dead without proper verification?

- Who approved the withdrawal of such a large sum?

- Why is the bank refusing to disclose the recipient account?

- What role did internal UBA staff play in the alleged fraud?

Legal and Regulatory Red Flags: Possible Breach of KYC and BVN Protocols

Financial experts say the incident points to serious breaches of Know Your Customer (KYC) and Bank Verification Number (BVN) regulations, which are designed to prevent impersonation and unauthorized account access.

“No bank in Nigeria should release funds of that magnitude without proper documentation and next-of-kin verification. This matter requires urgent investigation by the Central Bank of Nigeria (CBN) and Nigeria Deposit Insurance Corporation (NDIC),” said financial analyst Kenneth Iduh.

Calls for Immediate Intervention

Mr. Ehieribo is now appealing to:

- UBA Group to immediately rectify the error and refund his money

- Nigerian Police and EFCC to investigate the fraudulent claim

- CBN and NDIC to audit the bank’s internal procedures

- National Assembly to conduct a public hearing on systemic banking fraud

“I want justice. I came back home to rebuild my life. But now I am left with nothing,” he said tearfully.

Final Thoughts

This case is a chilling reminder of the vulnerabilities in Nigeria’s banking system, especially for foreign-based Nigerians who save diligently in local banks. If such a large sum can vanish under the guise of death without due process, it raises questions about the safety of customer deposits.

TJ News Nigeria will continue to monitor the situation and seek responses from UBA and relevant authorities.

#JusticeForHopeEhieribo

Additional Reporting: Omajemite Don

Publisher: TJ News Nigeria

Contact: [email protected]

Note: This article will be updated as more information becomes available or upon official statements from UBA or investigative agencies.

- Advertisement -